All about Business Debt Collection

Table of Contents7 Simple Techniques For International Debt CollectionHow Debt Collection Agency can Save You Time, Stress, and Money.The smart Trick of Debt Collection Agency That Nobody is DiscussingHow International Debt Collection can Save You Time, Stress, and Money.

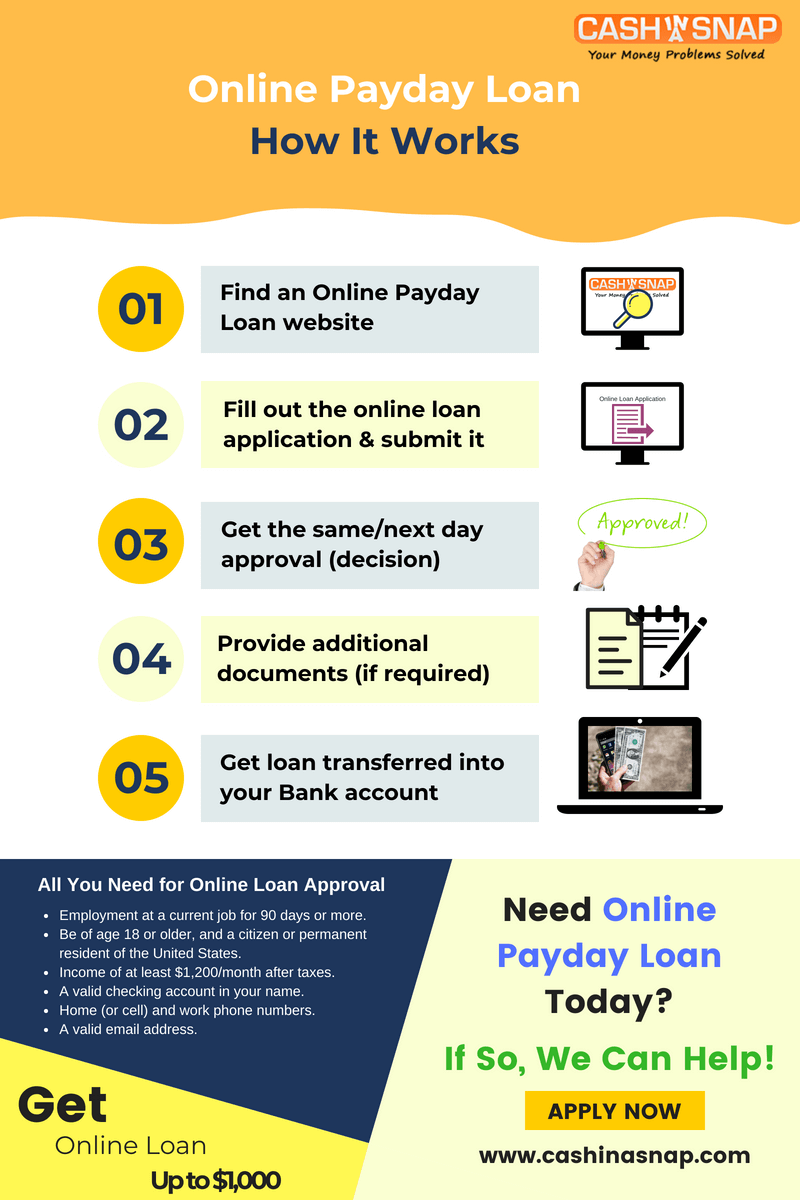

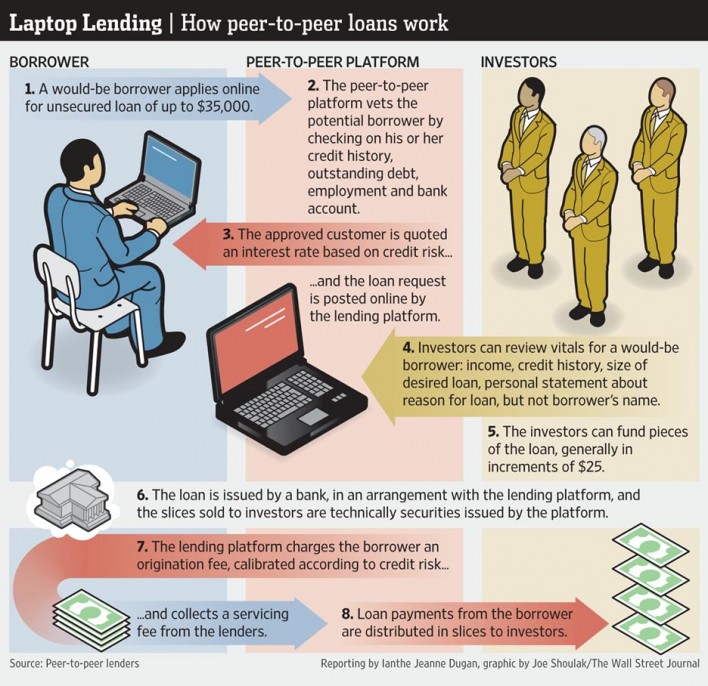

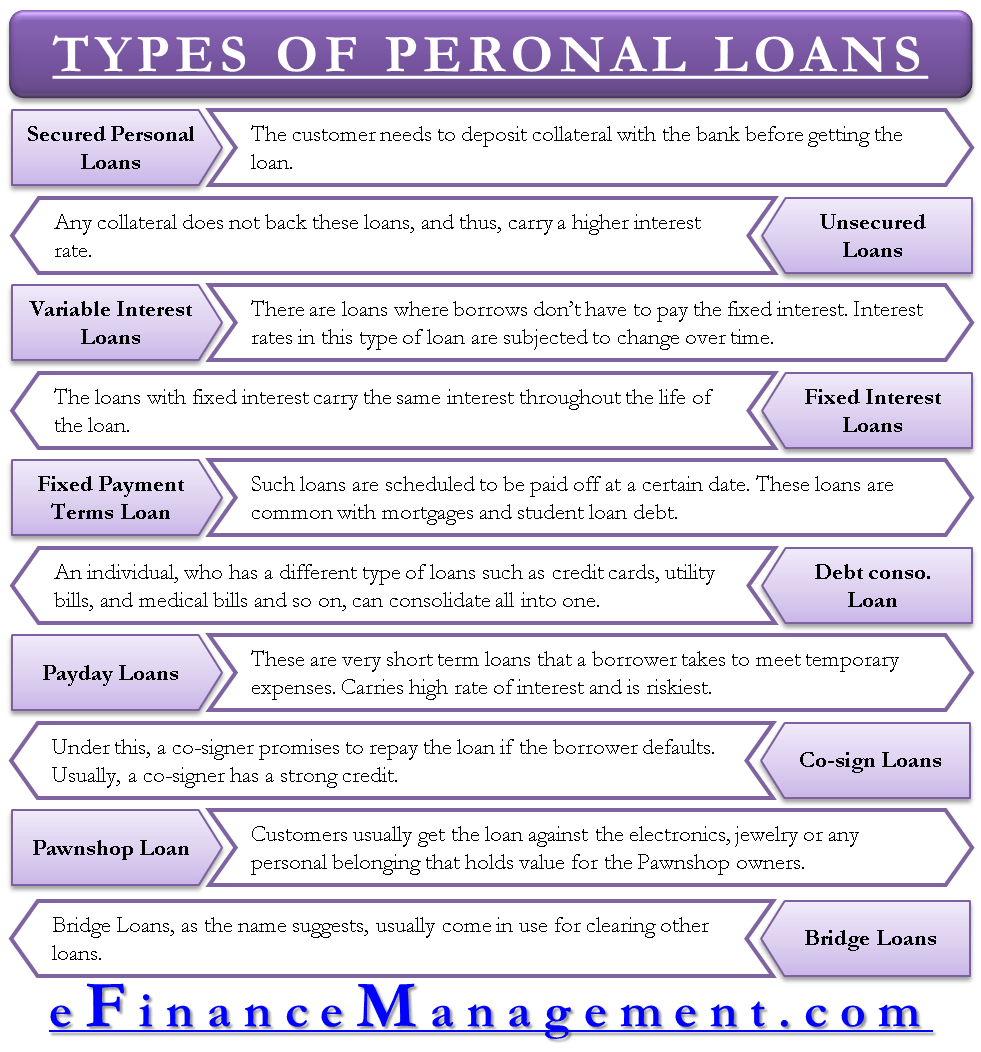

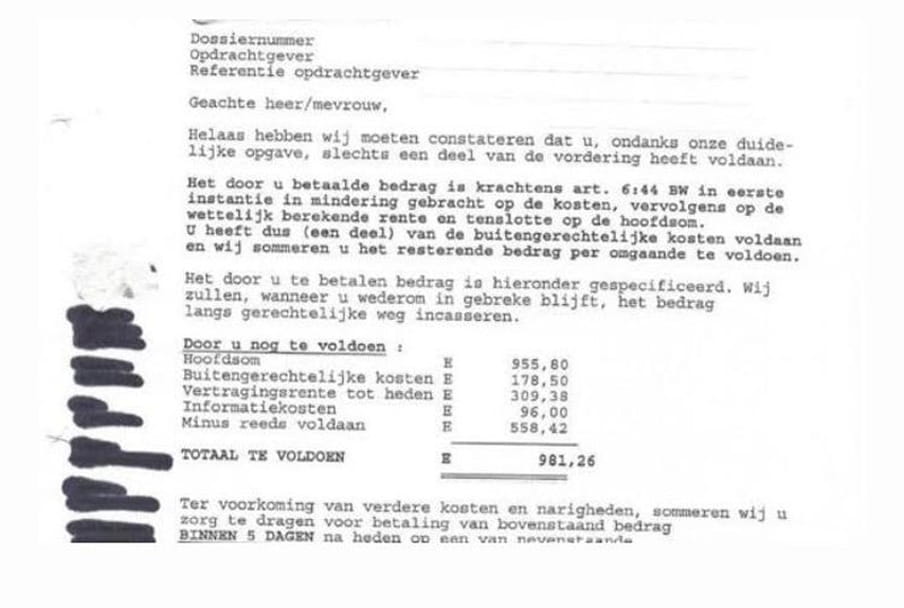

The financial obligation you owe demands to be addressed, and the absence of annoying telephone call or limitless letters in the mail box does not make the debt disappear. Entering debt doesn't occur overnight as well as neither does venturing out. However owing a person money does not indicate you should have to be adhered to around day and also evening by hostile financial obligation enthusiasts.Debt debt collection agency might be brought in if a company fell short to gather a superior financial obligation, usually after a 90-day past-due invoice. The lending institution or lender pays the financial debt debt collection agency a percentage of the billing to recuperate various financial debts, from charge card as well as clinical costs to service as well as utility costs.

After that, the firm will certainly connect to your consumers through composed notifications, call, as well as in-person visits if needed to get the cash you are owed. Your point of contact at the debt collector will certainly maintain you updated throughout the financial obligation recuperation procedure, consisting of contact attempts and whether they had the ability to resolve with the customer for the full invoice amount or a deposit.

Dental Debt Collection for Dummies

Collection firms typically obtain a compensation portion based on either the original billing amount or the amount of cash they accumulate usually 25 to 50%. Commissions differ based on financial debt age, kind, equilibrium, and the variety of times the account has actually been used. Remain on top of those in financial obligation, because the older an outstanding costs ends up being, the more hard it is to gather and also the greater the payment price for the enthusiast.

For organizations wanting to gather debts from unsettled billings, a collection agency will certainly use databases to track nonpaying clients and also contact them for payment. Depending upon the debt collection agency, you may not pay a cent for financial debt collection services unless the agency effectively accumulates the payment for you. In other situations, you might be called for to pay a certain amount no matter whether the firm is able to recuperate the financial obligation.

Deceiving a consumer to gather their financial obligation breaches the FDCPA. A collection firm can not go above an attorney's head to communicate with a consumer regarding their financial obligation. If a debt collector you're considering mentions any of the above as part of its process, it's wise to look elsewhere for debt collection help.

Fascination About Dental Debt Collection

You will certainly be accountable for calling debtors as well as work out repayments. You helpful hints will be the major individual accountable for recuperating the money owed in as little time as feasible. Maintain tracking arrearages, Plan strategy to recover owed cash, Find and also speak to debtors Bargain reward target dates as well as settlement strategies, Take care of clients' inquiries or grievances, Recognize gaps in the system as well as advise remedies, Develop trust with debtors Update account standing and database routinely, Follow requirements when lawful action is inevitable X years of experience as financial debt collector, Experience in collaborating with targets and also tight due dates, Expertise of relevant legal demands, Great expertise of MS Office and databases, Great arrangement and persuasion skills, Team player Great time-management skills Wonderful social and interaction abilities High school diploma is chosen.

For situations in the transport sector, 1 year is relevant instead. In some countries, constraint periods can be disturbed by sending a demand letter. Under the laws of England and useful reference also Wales, the limitation duration of invoices can be expanded by a More Help formal acknowledgment of the impressive quantity or partial repayment by the debtor

6 Easy Facts About Debt Collection Agency Described

Financial obligation collection companies can operate in the areas of, as well as. Within the structure of these tasks, debt collection firms like us see themselves as middlemans between creditors and borrowers.

As quickly as an enforcement order or an additional enforceable title has been issued, the debt collector can likewise use to make sure the customer obtains the case's worth.